Caution against the dangers of cryptocurrency bubble

Those who are not glued to every single sliver of tech and business news may have missed the meteoric rise and subsequent fall of bitcoin, the crown prince of the burgeoning cryptocurrency trend. Despite the amount of attention investors and market analysts have paid them in recent months, few members of the public actually understand what cryptocurrencies are or how they work. Put simply, cryptocurrencies are decentralized and anonymous currencies that rely on a complex system of algorithms to generate new units. Instead of a central authority like the Federal Reserve being in charge of the release of new currency units into the market, new cryptocurrencies are released by private individuals in a process called “mining.” Furthermore, production of cryptocurrencies decreases as their total amount increases, meaning that, over time, a hard cap will be created on how much can exist in the market, according to a Dec. 7, 2017 Economic Times article. Accordingly, the value of each individual unit is intended to skyrocket in value as investors and users become attracted to the currency. At the start of January 2017, each bitcoin was worth about $1,000; in one year, rampant speculation had driven up the value of each bitcoin to about $19,000, per bitcoin’s own internal price tracker.

Proponents of cryptocurrencies constantly state that they are the economic means of the future, destined to overtake government issued fiat notes and become the foundation of the global economy. For those firmly opposed to government intervention in the economy, cryptocurrencies like bitcoin and Ethereum are a dream come true, as they represent the first legitimate chance at wholly private commerce. As John McAfee, former CEO of McAfee Antivirus and former Libertarian Party presidential candidate, stated in a Dec. 7, 2017 tweet, “Those of you in the old school who believe this is a bubble simply have not understood the new mathematics of the Blockchain, or you did not care enough to try. Bubbles are mathematically impossible in this new paradigm.” McAfee may be a complex soul in many regards, but an economist he is not.

More grounded but still woefully deluded are the Wall Street and Silicon Valley set of cryptocurrency backers. Enthusiastic investors and technology boosters will tell you cryptocurrencies are the new hot investment on the block, overachieving bets sure to pay back hugely within days of buying. The Winklevoss twins, better known for their extensive legal battles with Mark Zuckerberg, recently became billionaires thanks to the massive amounts of bitcoin they bought before its value increase. In a Dec. 19, 2017 interview with the New York Times, Tyler Winklevoss proclaimed that, “We are very comfortable in very high-risk environments with absolutely no guarantee of success. I don’t mean existing in that environment for days, weeks or months. I mean year after year.” Like many others, the Winklevoss twins have bought into the hype and flash that cryptocurrencies provide, and for a short while profited quite handsomely for their troubles. However, merely having value does not make bitcoin or Ethereum or Ripple or any of the countless other cryptocurrencies floating around cyberspace an actual currency. How are we to be sure that bitcoin and its ilk aren’t in fact a digital tulip craze, destined to burst at any moment?

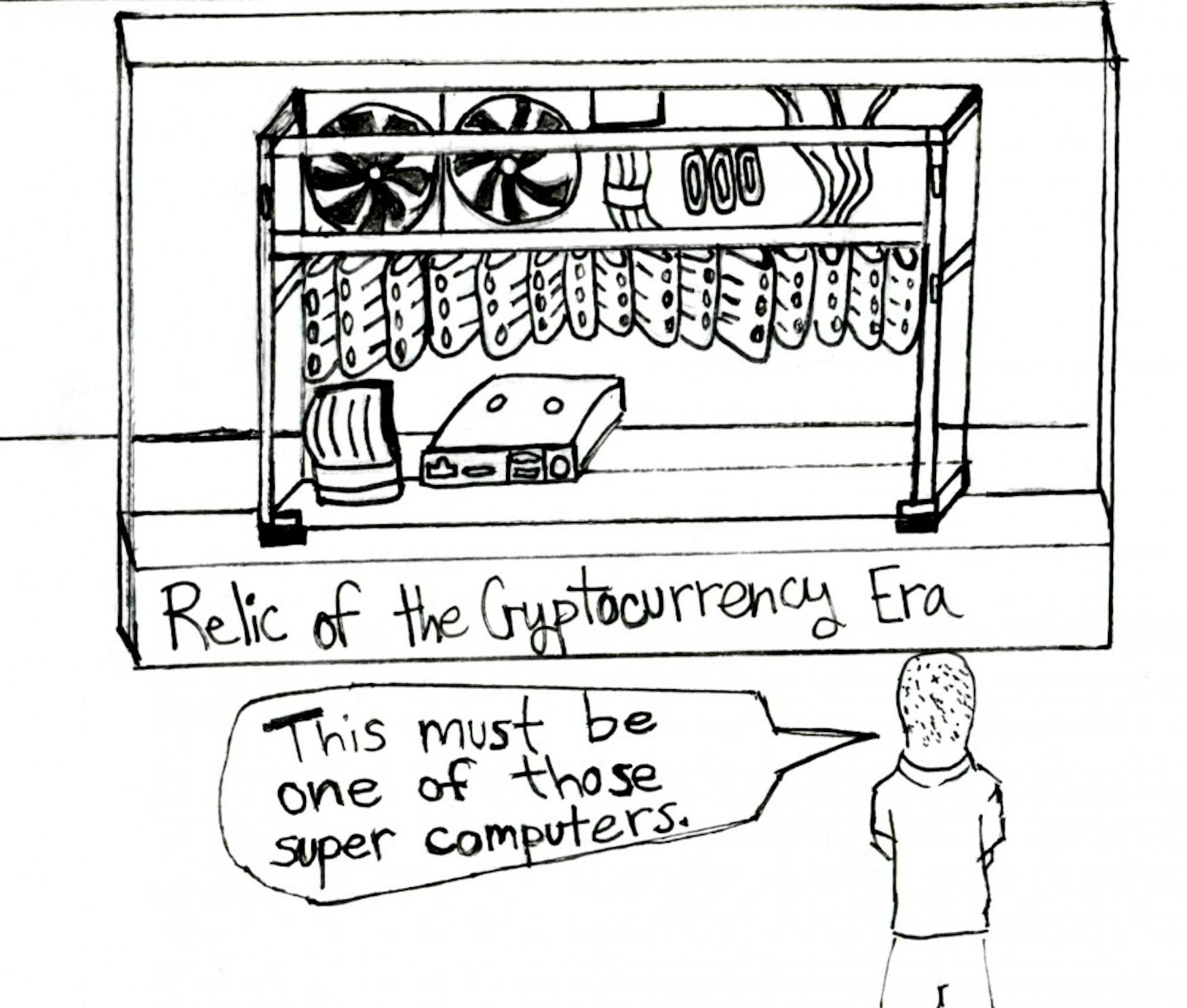

Unfortunately, it looks like the future of cryptocurrencies and bitcoin is not going to be the post-currency wonderland its proponents promise. Earlier this month, bitcoin and Ethereum began a seemingly inexorable slump, losing over half of their respective values in just a few short days, as reported by NBC News on Feb. 2. Given the completely anonymous nature of cryptocurrency transactions and the tremendous computing power required to process even the smallest transfer, they have an inherent volatility compared to traditional commodities. Volatility is the exact opposite of what traders want, since no market can operate long-term without some guarantee of stability. Why would a business willingly take payment in bitcoin if they don’t actually know what its value will be the very next day? Right now, the only goods most consumers will have experience purchasing with bitcoin are illegal items that take advantage of its anonymizing properties. No long-term substitute for government-issued currency gets its start as a vehicle for buying hitmen and Russian Xanax substitutes, as evidenced in a Dec. 7, 2015 Fortune article. Compounding this is the energy-guzzling nature inherent to cryptocurrencies, which demand both huge quantities of electricity to produce and transfer. If every single transaction requires an average transaction fee of $28, as reported by a Dec. 19, 2017 CNBC article, just to cover for the electricity use it incurs, what appeal is there to the average person trying to make ends meet? Even more troubling is the complete lack of oversight or insurance cryptocurrencies provide. If somehow the exchange you trusted to turn your virtual currency into tangible goods goes belly-up, or hackers manage to pilfer your digital wallet, you have no recourse whatsoever. Thousands and thousands of dollars are lost forever, fallen into the digital abyss from which they spawned.

Ultimately, cryptocurrencies currently amount to nothing more than a technological sideshow that could have dire consequences for their investors and backers in a very short time. While bitcoin and Ethereum have rallied from their historic tumble to some degree, this recent crash is far from the first, and it will certainly not be the last. Until any sort of meaningful attempt to take cryptocurrencies out of the speculative realm of Beanie Babies and Pets.com and into the world of reliable commerce emerges, invest in them at your own risk.

Please note All comments are eligible for publication in The Justice.