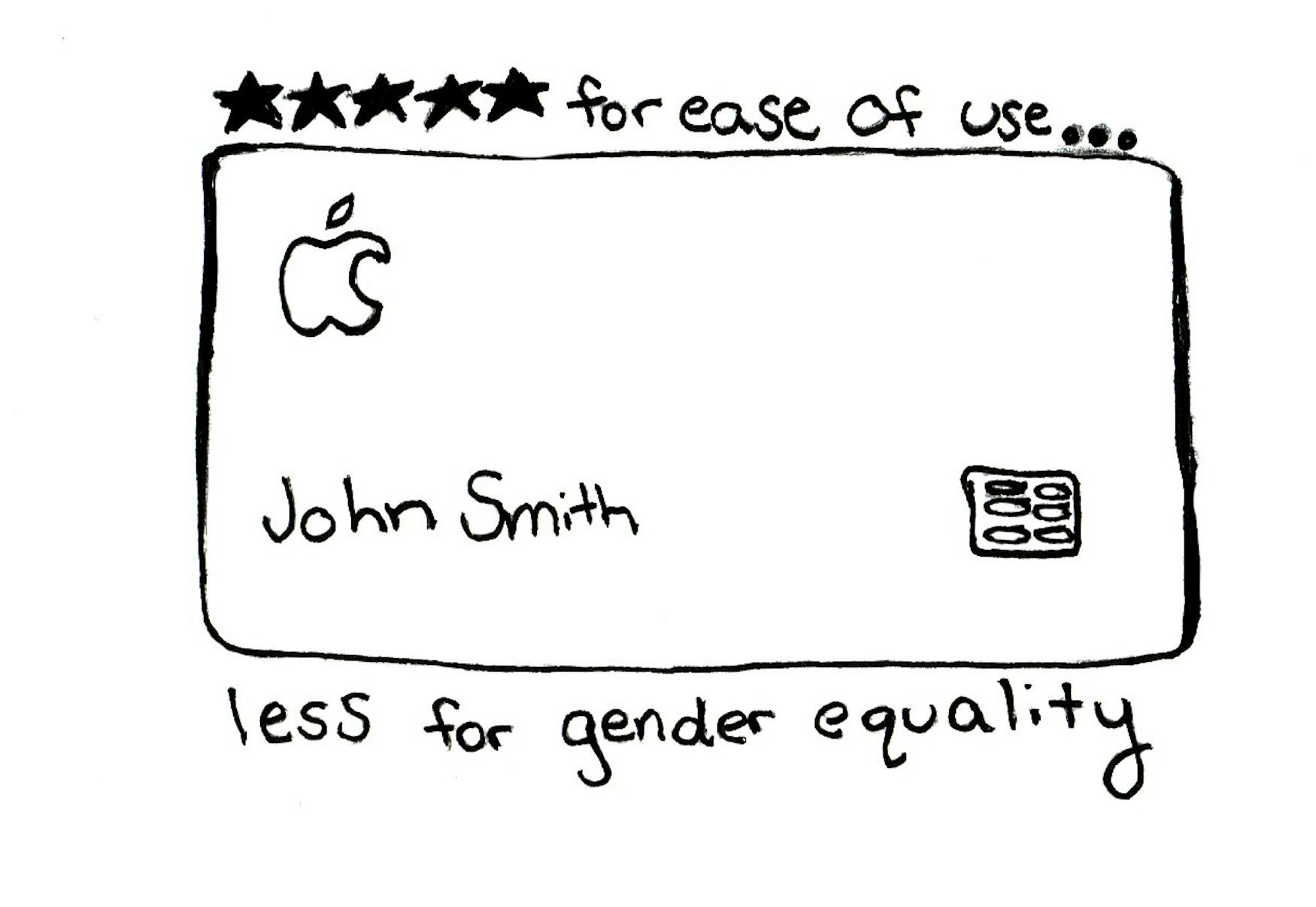

Apple Card gender discrimination reflects hidden biases

As if I don’t have enough student loan debt, Apple came out with a credit card just before the start of this semester. According to their press release, it’s “built on simplicity, transparency and privacy” with cash back, no fees and an easy user interface that allows one to view their spending along with enhanced security. Sure, once I’m employed maybe I can apply for one and add another Apple product to my tech ecosystem. And, it’s a credit card by Apple, not a bank But if you read the small print, the card is issued by Goldman Sachs Bank, United States of America, based in Utah. It seemed cool anyway, given its all white titanium exterior, with only the bearer’s name laser etched on it. To get the actual card number when not using Apple Pay or the Apple Wallet, you have to actually open the wallet app and verify your ID to access that information; the digital card number is different than the actual physical card number, which enhances the card’s security.

After doing that tiny bit of research, I forgot all about the Apple Card until early last week, when I saw a story about the Apple Card possibly having sexist algorithms for determining credit worthiness. In a series of tweets that went viral, David Heinemeier Hansson, the creator of Ruby on Rails and co-founder of BaseCamp, alleged that the algorithm behind the Apple Card was sexist because he got a credit limit that was twenty times as much as his wife’s. He further wrote that both he and his wife file joint tax returns, live in a community property state (where any property acquired by either member of a couple during a marriage is considered jointly owned by both) and pay off their bills in full every month. Then it got interesting. Co-founder of Apple Steve Wozniak tweeted in response that he and his wife, who had similar life circumstances to David Hansson and his wife, also had the same thing happen to them, except that in their case, Wozniak only received ten times the limit his wife got on the Apple Card. Again, the algorithm was blamed.

Hansson further tweeted that he had some difficulties dealing with customer support, and because of his status in the tech community, his customer service complaint was escalated, and eventually Hansson’s wife received the same amount of credit. Still, the service representative could not explain the logic behind the algorithm. The card itself is fairly simple to apply for, if you have an Apple phone with the latest iOS, use two factor authentication and are signed into iCould with your Apple ID. It knows your name already, and then you enter your date of birth, your address, your income from all sources and provide the front and back of your identification card.

But as Hansson was waiting to hear back from support, he was tweeting up a storm, and he further clarified his and his wife’s credit worthiness: His wife makes more money, he has more in assets, she has a higher credit score than he does and all of their credit cards are joint accounts, as are their other financial accounts. They own their home together as well. Hansson pointed out that the credit card was launched as “an innovative, new kind of credit card” and that he expected better from Apple.

A lot of responses agreed with Hansson, that the algorithm must be to blame. But a lot more than that is at work behind the scenes, and it may not be only a cut and dried issue like gender bias. A FICO score (FICO is a data analytics company formerly known as Fair Isaac Corporation that issues a three digit number known as your credit score) depends upon your payment history, the amount you owe, length of credit history, type of credit used and new credit.

There are three credit reporting agencies that could each have slightly different scores for the same individual. The bank issuing the credit card then takes that information, along with identity verification and your stated income from all sources to approve or disapprove of your credit card, to determine the amount of credit and its interest rate. In the case of the Apple Card, TransUnion is the credit agency used. I do not believe there is gender bias at work in Mr. Hansson’s example. However, there could perhaps be a systemic or institutional bias that is to blame for the initial amount of credit allocated to Mr. Hansson, and separately, to Mrs. Hansson. Women in many households tend to make a majority of the household purchases. This means that they are spending more than their male counterparts. If women are spending more, they might have more of that spending on a credit card, which would mean that their credit utilization rates are also higher. Women might not be the primary credit card holder; as the secondary account on a card, they are accorded less credit-worthiness by the reporting agencies. Finally, if Mrs. Hansson reported a lower income than her husband, she could have inadvertently triggered less access to credit for herself for quite some time.

And perhaps there is some unintentional bias that is still worth reviewing. Historically, for the most part, women have made less money than men. Women have had to pay more for certain things than men. This would mean that women have had to use more of their credit over time just to make up the salary differential that has existed.

It’s also important to note that Apple advertised this card as a card by Apple, not a bank. But way down at the bottom of the screen, Apple states that they have partnered with Goldman Sachs and that this is their first consumer credit card, which would make them more open to doing things differently.

Why all the outcry now? I would surmise that it’s because of David Hansson’s specific problem; because he felt betrayed by Apple when they marketed the Apple Card as being different, while the reality was that it was just another software algorithm, designed by human beings with access to a lot of data. Hansson was treated the way that anyone would get treated by the world’s most valuable company .

The truth is that the algorithms do need to get better. There’s too much faith placed in big data alone, without human oversight. In the meantime, all that has happened is that Mr. Hansson generated a lot of press for the Apple Card, and probably a lot of people probably signed up for the Apple Card. Eventually, this could mean that more people start using Apple Pay as their preferred form of mobile payment, which was what Apple wanted all along.

Please note All comments are eligible for publication in The Justice.