Universities, don’t just divest — invest with impact

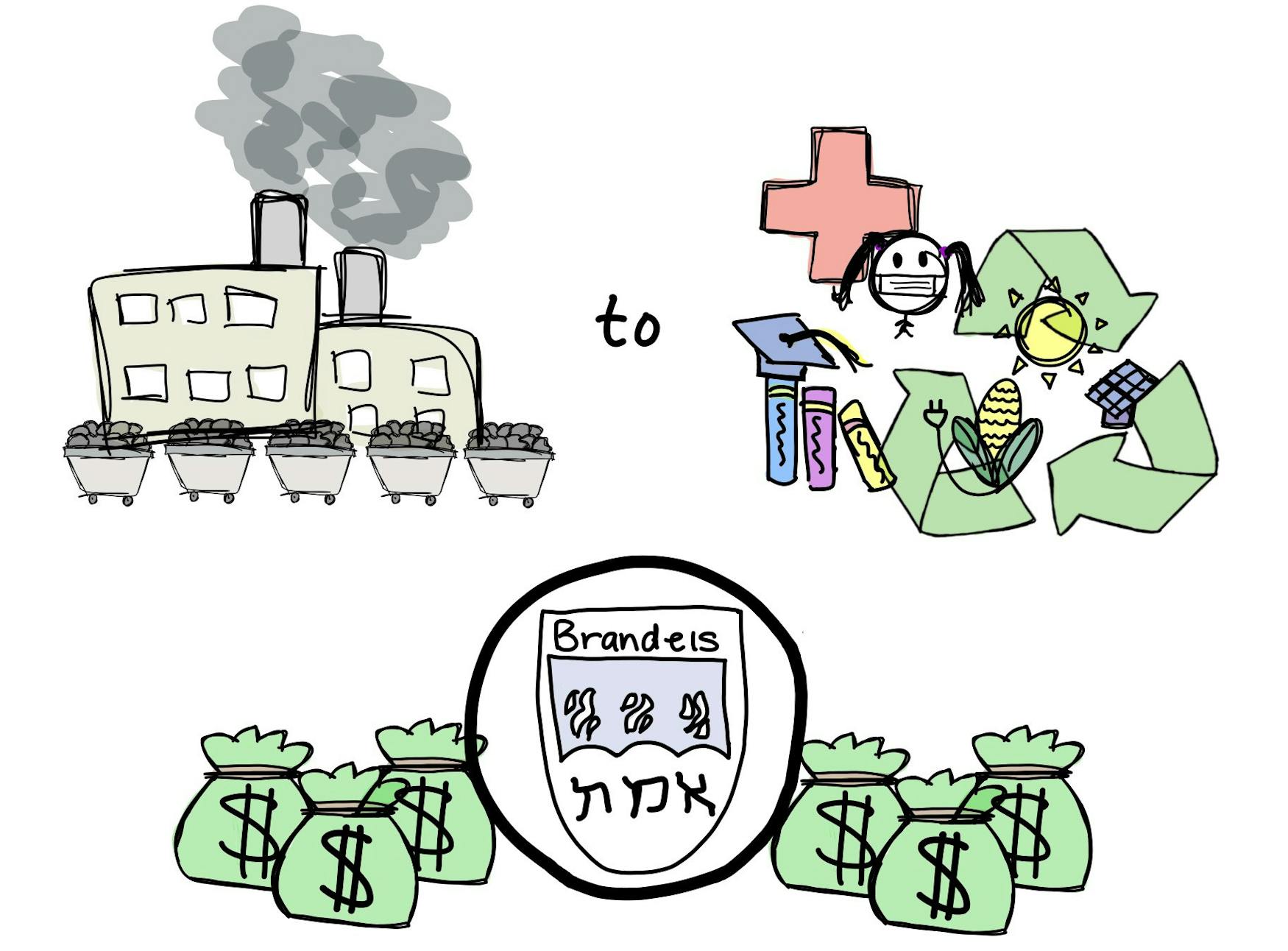

The Climate Movement’s call for divestment has been one of the most widespread and effective movements of our time. And with $617 billion in aggregate university endowments across the country, it’s important that universities invest portfolios that refrain from investing in oil and gas. But here’s the thing: our universities should do more than just divest. Rather, universities must invest in initiatives that support the kind of world we want to see. In other words, universities must start impact investing.

We can’t continue to pretend that universities are not complicit in reinforcing inequalities and contributing to climate change through our financial policies, even if we fully divest from fossil fuels. Divestment is important — critical, even. But universities, with forward thinking values and bold mission statements of social justice, should take a step further. Academic institutions should be the first to take the leap into mainstreaming impact investing and normalizing a lower financial return in favor of higher social and environmental returns.

Impact Investing is a vehicle for putting your dollars towards good. This kind of investing prioritizes additivity; not only limiting harm, but creating positive impact. Impact investing enables us to be part of the solutions we care most about — renewable energy, conservation, racial and economic justice, health care and education. It shifts the flow of capital away from big banks and big funds, and instead creates opportunities to finance positive social change.

When we talk about divestment from fossil fuels, we’re asking for “Socially Responsible Investing,” or SRI — not impact investing. SRIs take a “subtractive” approach. They’ll opt to refrain from investing in companies, such as oil and gas, that contribute to fossil fuel extraction. These ESG-focused funds, or funds focusing on environmental, social and governance factors, are important in that they create alternatives for those looking to make comparable market returns without investing in the climate crisis. However, these funds still keep dollars in the rotating world of Wall Street; they won’t invest in fossil fuels but will remain invested in Amazon and Big Pharma, for example.

In its long-awaited official statement on fossil fuel investment policy, the Brandeis Office of Investment Management stated in November of 2018 that it would “not divest from commingled funds that contain fossil fuel investments.” The statement also promised to review and update the university’s statement on Socially Responsible Investing, which has not been updated — to date — since 1973. Neither statement mentions anything about incorporating impact goals into its investment strategy.

In working towards alignment with institutional values, we must ask that Brandeis move beyond this initial request for divestment in accordance with the climate justice movement. We must demand investment in impact. We must start thinking about how our billion plus dollar endowment, and the endowments of universities across the country, can be a catalyst for creating renewable energy solutions, empowering marginalized communities and working towards a more equitable society.

Right now, the global impact investing market is $502 billion, according to the Global Impact Investing Network (GIIN)[1] – about $100 billion less than total US university endowments. Thus, if we put 100% of university endowments into impact, we could literally more than double the size of the entire impact investing market. Smaller contributions would be meaningful, too. If Brandeis put 1% of their endowment into impact investing funds, we could see an additional $10.5 million dollars earmarked for impact. 3% would be $31.5 million. 10% would be $105 million. That’s not nothing.

There are many ways we could invest in impact. Universities should start by researching local funds. Here in Boston, we have numerous options for impact funds. Boston Impact Initiative, BlueHub Capital and Sunwealth are all investing directly in racial and economic justice, affordable housing, healthcare, childcare, education and environmental sustainability. They are putting dollars behind things that matter. Most cities have local funds like these, and many have united under the umbrella of the New Economy Coalition.

Divestment is important. But our financial strategy shouldn’t just be about not doing bad; we need to hold ourselves accountable for being a part of the solution. It’s time our institutions start living our values. It’s time we start impact investing.

Please note All comments are eligible for publication in The Justice.