Though flawed, Obama's 'Scorecard' a useful tool

Earlier this month, the White House and the Department of Education released an online tool called the College Scorecard, which is designed help high school students and parents compare colleges and universities by showing "where you can get the most bang for your educational buck," according to President Barack Obama in his State of the Union address.

The idea of increasing the amount of accessible information college affordability was met by enthusiasm by many in higher education, but the actual system itself has been roundly criticized by experts, including Senior Vice President for Students and Enrollment Andrew Flagel, who say that its mechanisms and calculations are limited and need improvement.

"I think this is a way of thinking about affordability, [but] I think it's far from the only way of thinking about affordability," said Flagel in an interview with the Justice.

"It has a limited number of data points that it's examining, and it's always going to have a need to provide a significant amount of context, particularly for students who don't have access to robust counseling, who may not know, for instance, just how complex a calculation it is to understand what net price means to you individually," he continued.

The Scorecard provides students with information about colleges, including net price, graduation rate, loan default rate and median borrowing rate.

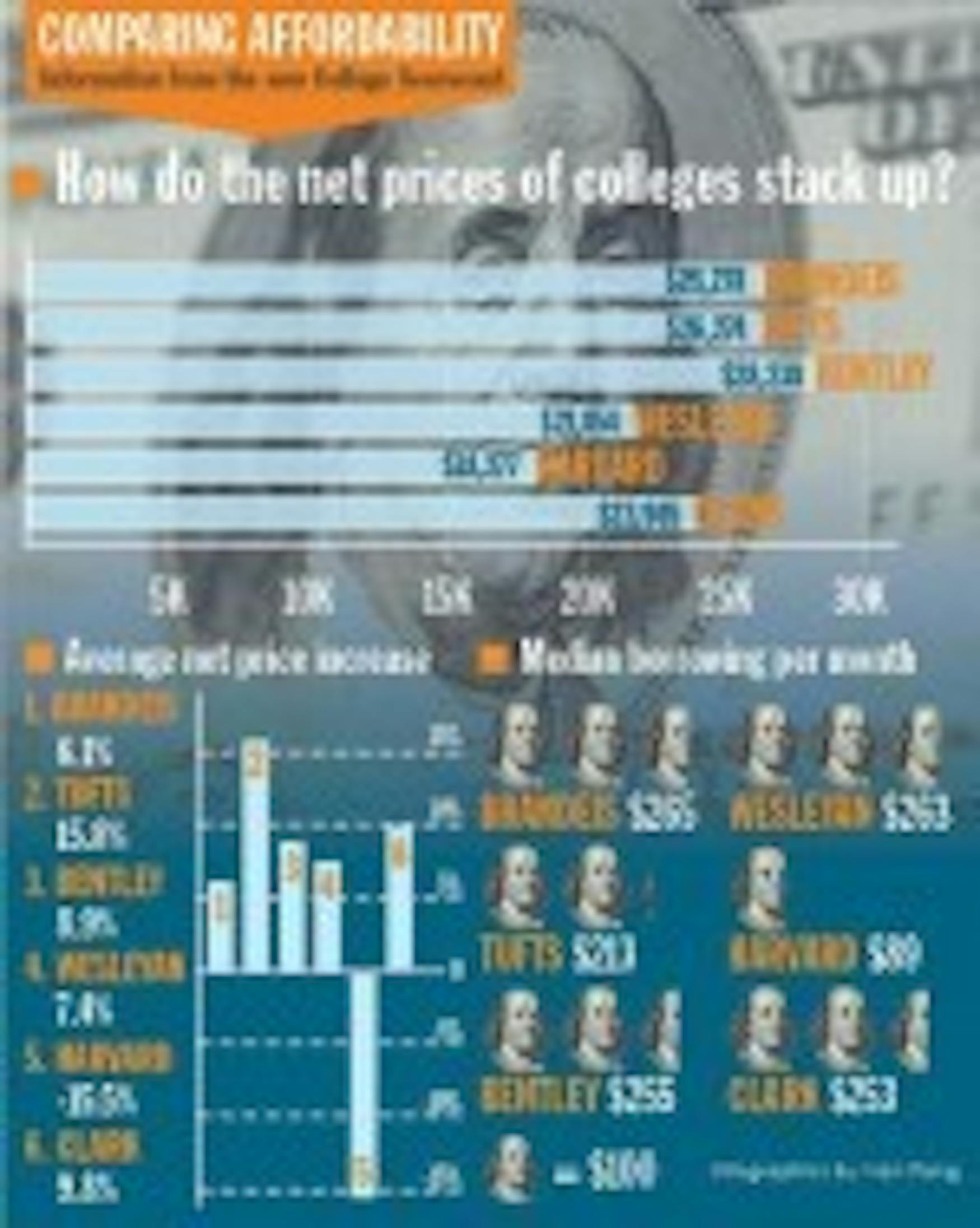

The Scorecard for Brandeis indicated that the average net price for students is $26,278 per year. The website explained that to calculate net price, the Department of Education subtracted grants and scholarships from the institution's cost of attendance, which this year was $56,716, according to the Brandeis website. The Scorecard also listed an average net price increase of 6.1 percent from 2007 to 2009. Many similar schools to Brandeis, such as Tufts University, Bentley College and Clark University, increased their net price by a greater amount in that time period.

The Scorecard additionally listed Brandeis' graduation rate as 91.2 percent and its median borrowing amount as $23,000, meaning that families of students on average borrow that amount in loans.

Also according to the Scorecard, only 1.9 percent of students who borrow money while attending Brandeis default on their Federal loans after graduation.

Flagel emphasized that each of these figures represent complex calculations that may be vastly different for individual students. For example, he said, if someone takes out more loans than they need to pay for college and uses the money for something else, such as a car or apartment, "is that the school's issue, or is that an individual student issue?"

Other experts felt similarly that the Scorecard was a well-meaning but flawed initiative.

According to an article in the New York Times, the Institute for College Access and Success called it "two steps forward, one step back," and Terry W. Hartle, a senior vice president of the American Council on Education, said that the Scorecard is "not a game-changer as much as the administration would like to believe."

Michelle Singletary, a parent who wrote a column about the Scorecard in the Washington Post, wrote that "the tool ... is too general when it comes to the final price of college" and that it "doesn't address the most pressing needs" of parents.

"It is useful to have this among the tools, [but] I don't think it's particularly brave or ground breaking the way it's been presented, I think there are some modifications that are really wanted," said Flagel.

One such modification that he suggested was providing the 25th to 75th percentiles in terms of net price, rather than showing simply one figure, the median, which might not mean much to individual students.

"I think for both that, and for things like borrowing rates, those would be much more useful data points," Flagel said.

Please note All comments are eligible for publication in The Justice.