Consider the risks involved in online grocery expansion

In a Jan. 26 China News Service article, several industry researchers and CEOs expressed their concern about the lack of growth in the e-commerce industry. “The bonus generated by online expanding doesn't exist anymore,” said Xing Wang, the CEO of Meituan, the biggest tech firm providing group buying and crowd-sourced review services in China.

Even though the giants of e-commerce are still experiencing notable revenue growth, firms can no longer earn a considerable profit by simply moving their retail business online. In the long run, due to the increasing ubiquity of online shopping and growing competition from startups, e-commerce firms will need to find new ways to gain an edge over competitors.

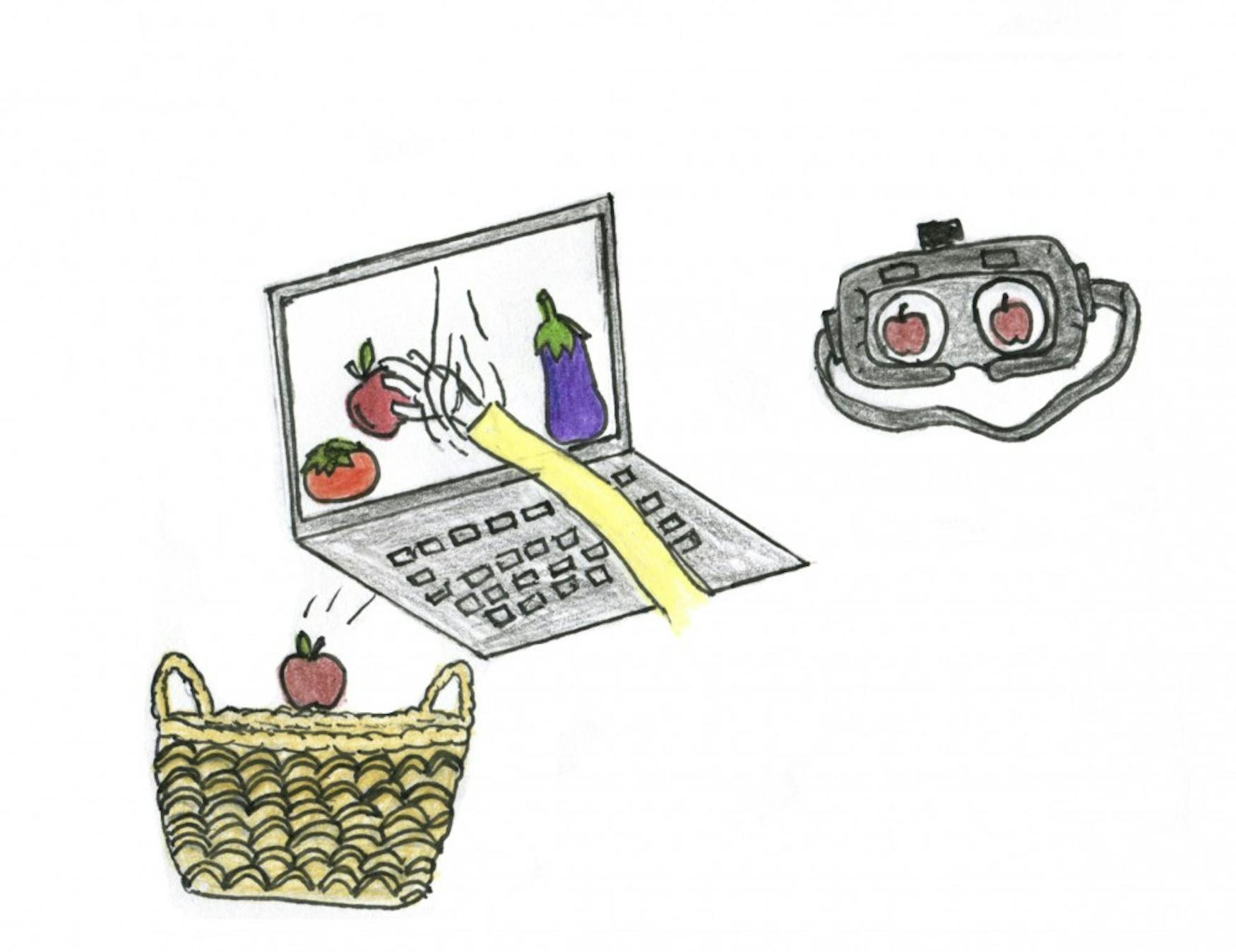

It is not a coincidence that both Alibaba and Amazon are planning new expansions in online groceries. In 2007, Amazon launched its online grocery service, Amazon Fresh. 10 years later, Amazon made the bold move to acquire Whole Foods Market to support its online grocery retail. In China, Alibaba opened 13 innovative grocery stores called “Hema Market,” which covered major metropolises in China, to provide a grocery shopping experience that combines traditional grocery stores with the online shopping experience. Why is grocery retailing so appealing? It seems like all the e-commerce firms are trying to seek their new profits in this subsidiary market.

Most importantly, the grocery retail market makes up a huge part of the retail industry. The grocery market in the United States is about $675 billion, and over 90 percent of households shop for groceries at least once a week, as reported in a Jan. 17, 2017 Forbes article. At the same time, e-commerce has not yet taken over the grocery retailing market very much like other categories. According to a June 2017 International Institute for Management Development

report, online grocery only accounts for 6 percent in the UK, 5 percent in the U.S. and less than 2 percent everywhere else. It seems like online grocery is an opportune market awaiting the giants to take advantage, but can these e-commerce giants disrupt the traditional grocery retail as they did other fields?

The online retailers store their goods in gigantic warehouses far away from cities, and after receiving the orders, they pack the products in boxes and ship them with huge trucks. This standard shipping formula works well with electronics, books and packaged food, but online retailers cannot simply transfer this formula to sell groceries. People live off of fresh groceries that perish easily, such as eggs, fruits and vegetables. It is tempting to cut out the middleman and sell groceries directly from the warehouse to consumers, but the firms would have to invest in a new warehouse and delivery system to ensure the customers receive the groceries at least as fresh as they can buy in brick-and-mortar grocery stores. This would require fast shipping to prevent food spoiling. Hence, the extra delivery cost required to build the fast shipping system hinders e-commerce in the first place. The cost comes in different ways. First, whether the existing delivery system can ensure the freshness of groceries is still questionable. Last November, Amazon shut down the delivery service of Amazon Fresh in nine states because “USPS frequently delivered late or not at all,” according to a Nov. 3, 2017 Recode article.

If online retailers want to sell groceries online, they at least need to ensure the users receive the food before it perishes. This means that they have to upgrade the existing delivery system or build a new system on their own. Second, the e-commerce firms would have to expand their warehouse system to fit the demand of fast shipping. To make sure the groceries are delivered in a timely manner, the warehouses need to be close enough to heavily populated urban areas. Building or acquiring these warehouses will come at a steep cost.

“Grocery is the most alluring and treacherous category. It lures inventors and retailers with shopping volume and frequency, and then sinks them with low margin,” said Nadia Shouraboura, a former Amazon executive, as quoted in a March 20, 2017 Bloomberg report. Had the e-commerce giants solved the problem of delivery, they might not have gained the expected profit due to the razor-thin margin of the whole grocery retail industry. To support the Amazon Fresh warehouse, Amazon purchased Whole Foods Market for $13.7 billion for its high-quality grocery goods and more than 460 stores in the U.S., Canada and U.K, according to a June 23, 2017 USA Today report. But will this turn their current loss into a profit? The SEC report of Whole Foods of Quarter One 2017 shows that Whole Foods had sales of $3.7 billion but only $99 million of operating profit, which means the margin was just 2 percent. These numbers show that it is still hard for online retailers to maintain a competitive price or make a profit. Even if the 460 Whole Foods locations solved the obstacle of warehouses, combining the massive delivery cost of online grocery and the low margins of retail is a hard sell.

Last but not least, do consumers demand online groceries at all? Note that the advantages of online retail in other categories do not necessarily apply to the online grocery sector. The online shopping experience usually provides users with a lower price than brick-and-mortar stores, but considering the high delivery cost and thin margins, it is hard for online retailers to offer a similar competitive price for groceries. What's more, people enjoy comparing products from different sellers and brands with abundant review data generated by online sales. But in the reality of groceries, consumers tend to have a stable list of vegetables and meat they want and buy them over and over again. No one bothers to read the comments for the potatoes they cook every day. Most importantly, why not take a 20-minute trip to a real grocery store and smell the oranges or flick the watermelons to see if they are really of good quality or not?

In 2012, 4.2 percent of shoppers made frequent purchases in online grocery stores, and after rounds of heavy investments from companies like Amazon, that percentage rose slightly to around 5 percent, according to the same Bloomberg report. Firms facing this frustrating reality need to reconsider their expansion strategy. The newly opened Amazon Go store may tell where the future of grocery retail is. This brick-and-mortar grocery store molded by the technology titan is armed with cutting-edge techniques in computer vision, artificial intelligence, and data science. Instead of figuring out a way to cut the costs associated with fast delivery, it aims to resolve the problem of long checkout lines found in the traditional grocery store model and focus on the demand of buying groceries on the go. The technology is the most valuable asset and competitive advantage of tech firms.

Instead of following the old online-only business model, discovering the actual pain points of consumers and enhancing shopping experiences in stores would be a more conceivable way for the technology giants to break into the fruitful grocery retailing market.

Please note All comments are eligible for publication in The Justice.