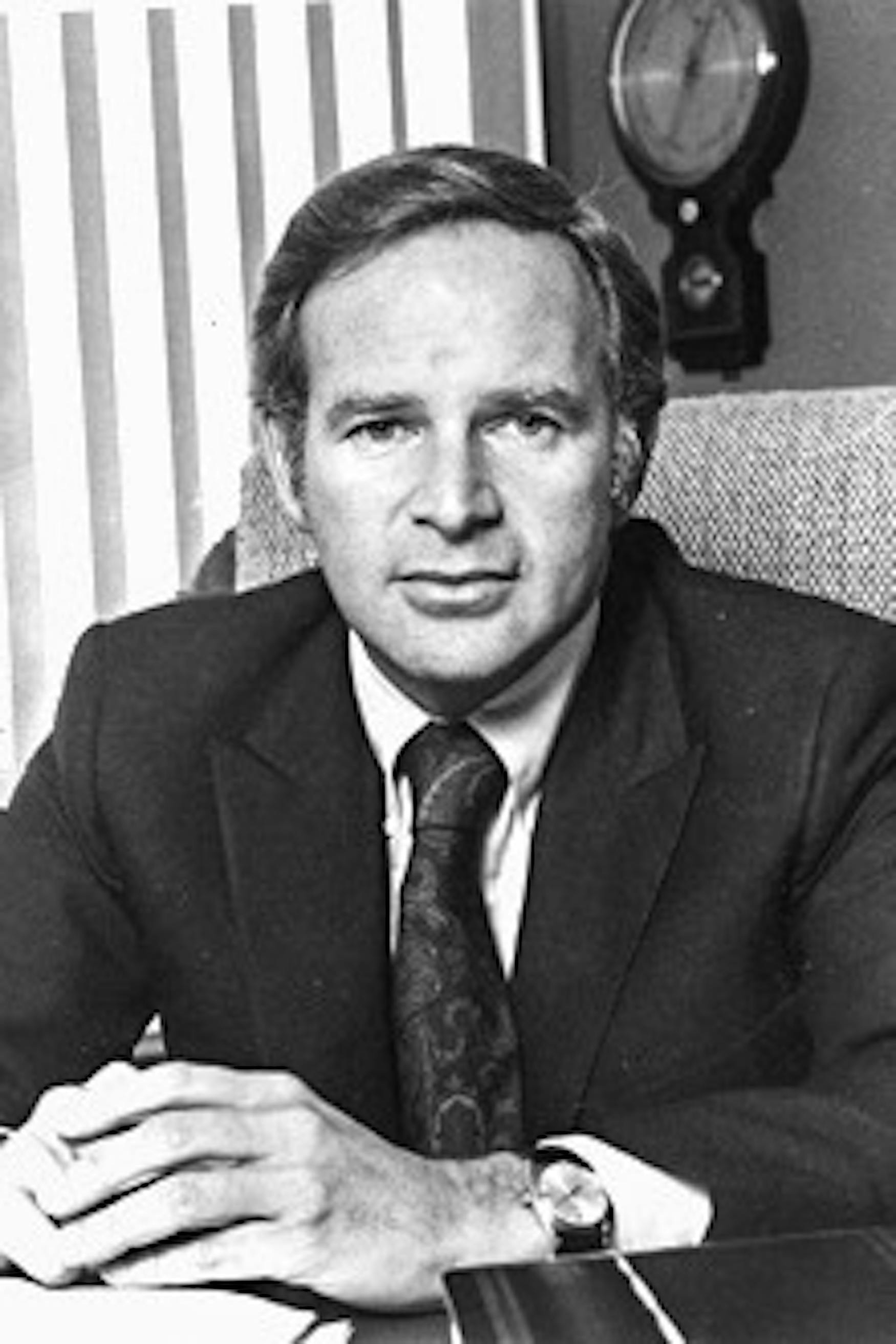

Former Board member passes away at age 84

Former Brandeis Board of Trustees member Arthur Cohen passed away on Aug. 9 at his home in King’s Point, N.Y. Cohen served on the Board from 1973 to 1988, when he was named trustee emeritus.

According to an Aug. 12 BrandeisNOW article, Cohen and his wife Karen Cohen generously supported Brandeis by “establishing the Arthur and Karen Cohen Reserve Room in Farber Library and making gifts to the Annual Fund and for student scholarships.”

Known for his work in the real estate industry, Cohen founded the Arlen Realty & Development Corporation in 1971, whose first major project was developing Olympic Tower in Midtown Manhattan with shipping magnate Aristotle Onassis. The Olympic Tower project reimagined zoning regulations in Manhattan by allowing residential, office and shopping space in the same building.

According to an Aug. 15 New York Times on his passing titled “Arthur G. Cohen, Real Estate Developer, Is Dead at 84,” Cohen started his real estate empire by investing $25,000 in tract housing on Long Island. With the creation of Arlen Real Estate & Development Corporation, Cohen became known as an innovative investor in the real estate world, specifically developing locations in New York City, like Times Square and the old Madison Square Garden site.

The same New York Times article, which referred to Cohen’s real estate career as a “roller coaster,” described his development strategy. Cohen would “select property with a good chance to increase in value, recruit partners and then borrow the full amount of the development cost,” while contributing his own creativity and “sweat equity.” To Cohen, money was not an obstacle to his success because he started in the business without existing capital.

Cohen often worked outside the limelight, leaving the publicity to his partners. “His behind-the-scenes ability to structure elaborate deals nonetheless dazzled the industry,” according to the New York Times. Referencing a 1972 Fortune magazine article, Cohen can be described as having an astute focus for slicing “immediately to the heart of intricate problems.”

Born in Brooklyn, N.Y., Cohen received a bachelor’s degree from the University of Miami, followed by a law degree from the New York Law School. He was also a long-term member of the New York Bar Association. According to an Aug. 15 article from the New York Times, Cohen was “exposed to the real estate business through shoptalk at the dinner table and summer work assignments” at an early age from his father’s investments in gas stations and apartment buildings.

Aside from real estate, Cohen is remembered for his service to various institutions, including serving as a trustee to the Jewish National Fund, Long Island Jewish Medical Center, New York Law School and the John Hancock Mutual Fund. Cohen also received the Man of the Year award from the Anti-Defamation League and City of Hope, and an honorary degree from Long Island University.

Cohen also guest lectured at both Harvard Business School and the Wharton School of Business at the University of Pennsylvania, and also held directorships at Citicorp, Chicago Title Insurance Company and the John Hancock Mutual Fund. According to BrandeisNOW, Cohen worked as “part of the Special Mission to Israel under Prime Minister Golda Meir and serv[ed] as special envoy to aid underprivileged nations under President Lyndon B. Johnson.”

Cohen is survived by Karen, his wife of 60 years, their five daughters, his sister and nine grandchildren. According to the New York Times, his wife’s father Charles Bassine influenced Cohen’s success with his early support, as well as collaborative financial deals. The New York Times also explained Bassine’s fondness for Cohen with a quote from a board meeting negating claims of nepotism. “I cordially wish you all such a son-in-law,” he said. “He’s a better man than I am.”

Please note All comments are eligible for publication in The Justice.